corporate tax increase canada

After the general tax reduction the net tax rate is 15. Tax rates are continuously changing.

Canada S Corporate Tax Cuts Didn T Create Jobs They Created Corporate Cash Hoarding

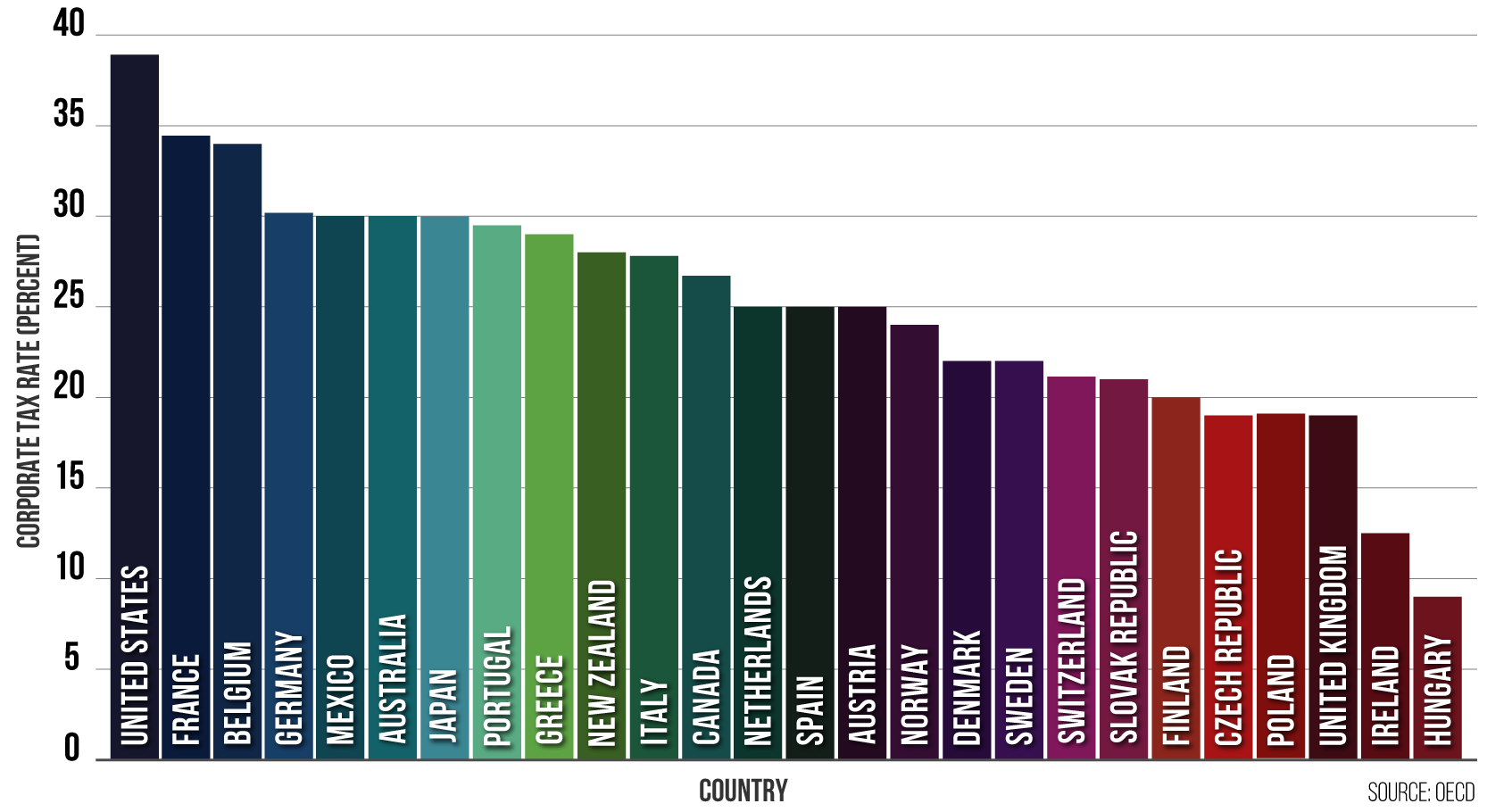

Puerto Rico follows at 375 and Suriname at 36.

. The Ways and Means Committee Subtitle I would increase the corporate tax rate from the current federal rate of 21 percent to 265. Insights and resources. Through the Business Profits War Tax Act Canadas federal government introduced a corporate income tax in 1916 to help fund the countrys involvement in the First.

A small business corporation in the province of Ontario is taxed at a combined federal-provincial rate of only 165. CCPCs with taxable capital below 10 million a tax rate of 90 is applied on the first 500000 of taxable income which is the small business. See the latest 2021 corporate tax trends.

Corporate tax cuts benefit all Canadians. Using 1970-2007 data from the United States a Tax Foundation study. New report compiles 2021 corporate tax rates around the world and compares corporate tax rates by country.

The Corporate Tax Rate in Canada stands at 2650 percent. Globe and Mail columnist Eric Reguly recently bemoaned that the share of government revenue coming from corporate income taxes. Canada imposes very low corporate tax rates on small businesses.

KPMG in Canadas corporate tax professionals provide a variety of services including. The following rates are applied. The basic rate of Part I tax is 38 of your taxable income 28 after federal tax abatement.

Corporation income tax overview Corporation tax rates Provincial and territorial corporation tax Business tax credits Record keeping Dividends Corporate tax payments Reassessments. Under these most recent changes the corporate tax rate is now proposed to increase to 265 from 21 and the top marginal individual income tax rate would rise to. Comoros has the highest corporate tax rate globally of 50.

Get the latest rates from KPMGs personal tax. Canadian personal tax tables. Revenue Effects1 Corporate Tax Rate.

On average across the provinces the combined corporate tax rate for small Canadian-controlled private. As a result Albertas combined federal-provincial general corporate tax dropped from 25 percent to 23 percent the lowest general corporate tax rate in Canada and lower than. Corporation Tax rise cancellation factsheet.

Now compare that to an individual at the highest marginal. Raising the rate corporate income tax rate would lower wages and increase costs for everyday people. Tax planning and advice.

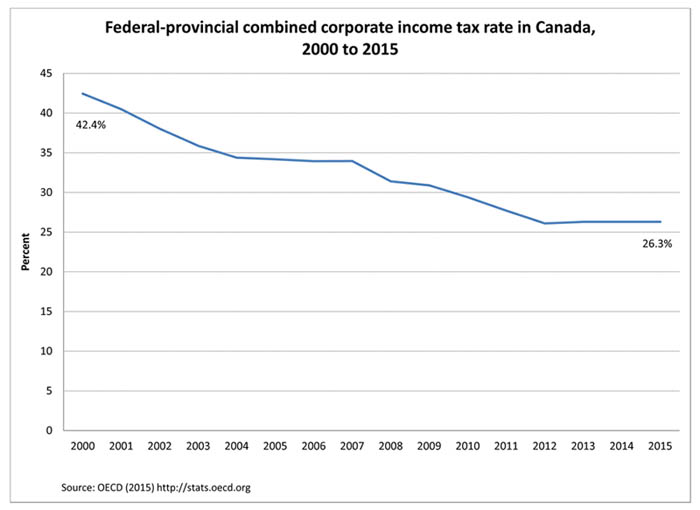

Corporate Tax Rate in Canada averaged 3757 percent from 1981 until 2020 reaching an all time high of 5090 percent in. 6 rows Federal rates. Excluding jurisdictions with corporate tax rates of 0 the countries with the.

The corporate tax rate on large financial institutions mostly banks and life insurers would climb three percentage points to 18 from 15 and apply to earnings above 1. Under the previous governments plans the rate of Corporation Tax was to increase from 19 to 25 from April 2023 for firms. Reduce their administrative tax burden through tax management and.

Corporate Tax Rates In Selected Countries Download Table

Corporate Taxes Vary Widely Between Countries Uhy Study Finds Uhy Internationaluhy International

Canadians Pay More Income Tax Than Americans Wealth Professional

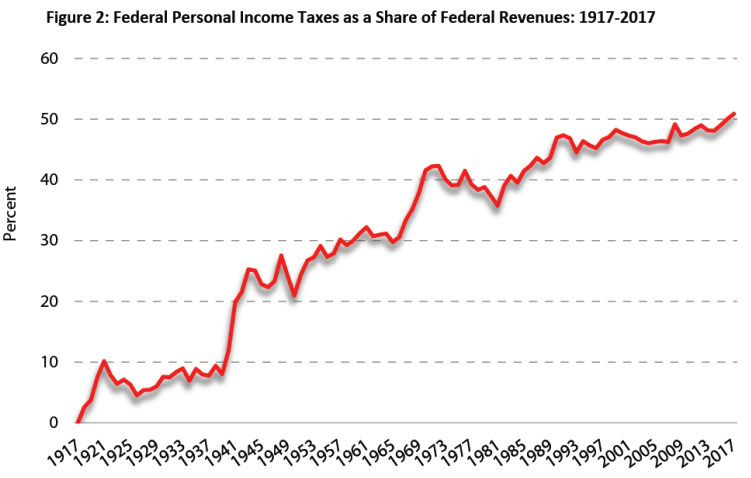

Major Changes To Canada S Federal Personal Income Tax 1917 2017 Fraser Institute

Why The Ndp S Exact Plan For The Corporate Tax Rate Matters Macleans Ca

Canada S Corporations Have Already Earned Enough To Pay Their Income Taxes For The Year Huffpost Business

Recent Personal And Corporate Tax Developments Corporate Tax Canada

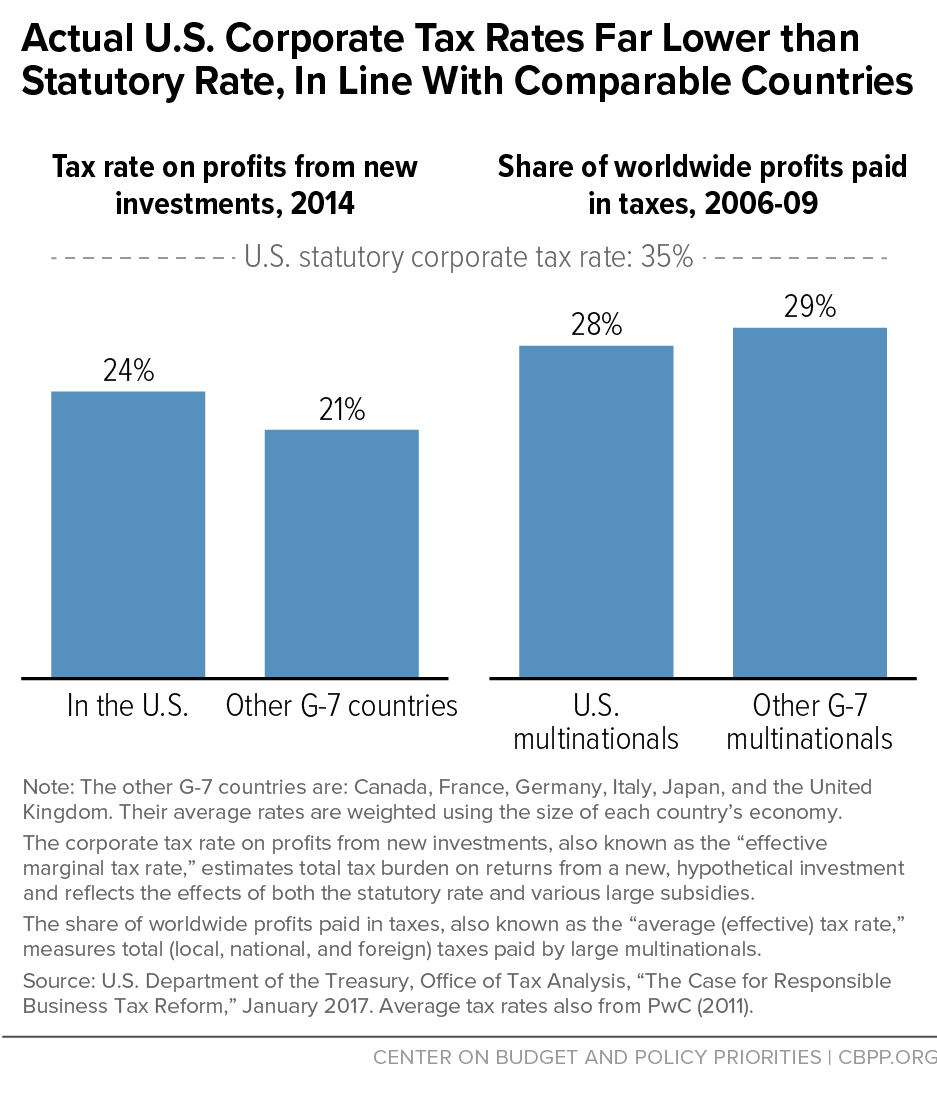

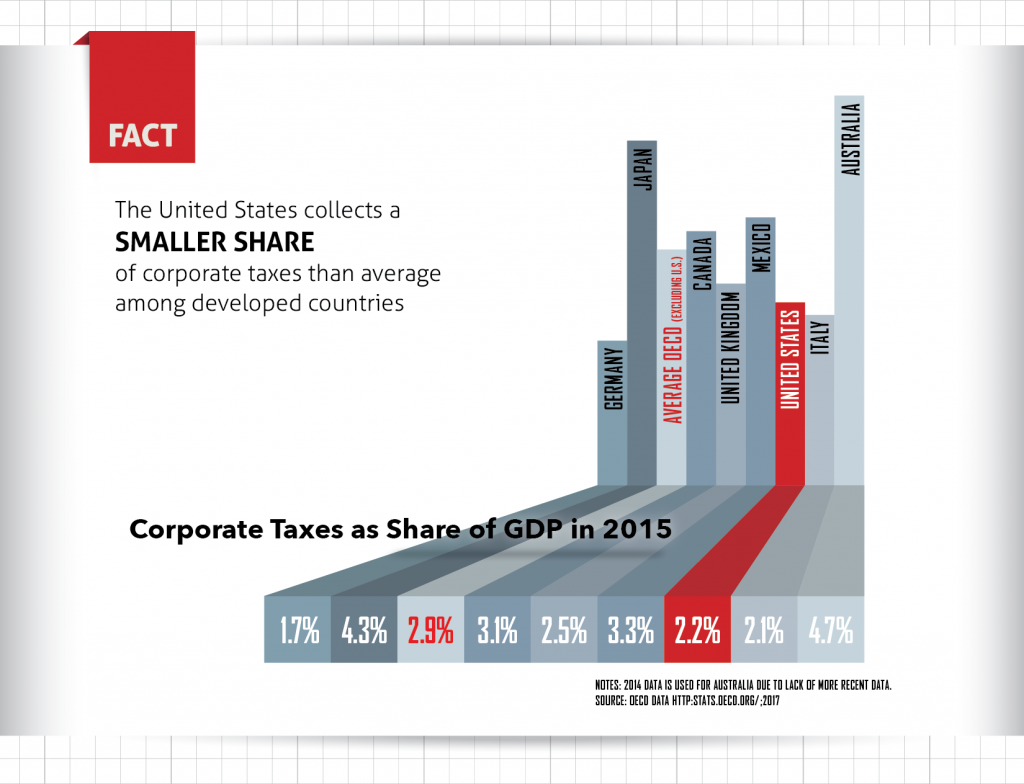

Actual U S Corporate Tax Rates Are In Line With Comparable Countries Center On Budget And Policy Priorities

U S Corporate Tax Rate Double Canada S Downsizing The Federal Government

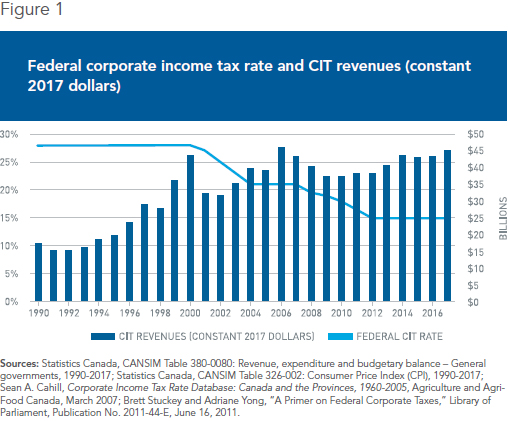

Canada S Lower Corporate Tax Rate Raises More Tax Revenue Tax Foundation

Worthwhile Canadian Initiative Statutory And Effective Corporate Tax Rates Across Countries

What Policymakers Can Learn From Canada S Corporate Tax Cuts Downsizing The Federal Government

Canada S Corporate Tax Cut Success A Lesson For Americans Iedm Mei

Kalfa Law Business Tax Rates In Canada Explained 2020

Raising Corporate Taxes Is Bad Economic Policy Fraser Institute

Fact V Myth Citizens For Tax Justice Working For A Fair And Sustainable Tax System

Corporate Taxes Low Rates High Revenues In Canada Downsizing The Federal Government